tax credit survey mean

The survey found that 26 of people ages 18 to 24 use credit unions while 36 of people in this age group opt for national banks such as Chase Bank of America US. Last year more than.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

People between the ages of 25 and 34 are even less likely to use a credit union with only 14 being members of one.

. As Voxs Li Zhou wrote in October Manchins mean-testing push overlooks a few problems including that means-tested benefits can actually be more expensive to provide harder to sell. Tax filers like its easy-to-use interface and question-answer survey when completing taxes. 28 urged people to use the information on their individual online taxpayer accounts for the most accurate figures when preparing their taxes and claiming the.

POPULAR FOR TAX PROS. The adoption tax credit is currently a nonrefundable credit. TurboTax ranks No.

Tax season is off to a bumpy start for some of the millions of taxpayers who received Child Tax Credit CTC payments last year because a key tax form from the Internal Revenue Service has errors. The Deloitte US consumers credit card payments survey was fielded in August 2019 querying 2520 respondents in the United States who have at least one credit card and one debit card. It helps many families but could help many more families if it were refundable.

Most states provide a similar credit making the average potential benefit of the federal and state credit in the range of 10-20 of qualified spending. Refundable vs non Refundable. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

Created in 1981 to stimulate research and development RD in the United States the RD tax credit is a dollar-for-dollar offset of federal income tax liability and in certain circumstances payroll tax liability. A refundable tax credit is one. Another way to think of a tax credit is as a rebate.

The second round of the advance monthly portion of the Child Tax Credit for 2020 hit bank accounts earlier last month but the growing balance has people worried if. Every year the average US. Household pays over 8800 in federal income taxes according to the Bureau of Labor Statistics.

Bank and Wells Fargo. How To Claim the Full Amount On Your 2021 Taxes As GOBankingRates previously reported an IRS fact sheet released Jan. The Disability Tax Credit DTC is a non-refundable tax credit created by the Canadian Government and Canada Revenue Agency CRA and its purpose is to reduce the amount of income tax Canadians with disabilities andor their families and supporters would have to pay annually hence assist with the various financial implications and expenses of having a.

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. The 26 tax credit is a dollar-for-dollar reduction of the income tax you owe. The survey explored consumers.

Marie Sapirie examines the proposal to repeal or at least raise the state and local tax deduction and the efforts to expand the child tax credit. Latest news and information on President Bidens Build Back Better bill plus updates on a fourth stimulus check the Child Tax Credit and Social Security. And while were all faced with that same obligation there is significant difference when it comes to state and local taxes.

We set minimum quotas for age and targeted an equal gender representation and an income distribution around a median annual income of US75000. Families with 60 million children were sent the first monthly check. Child Tax Credits land in families bank accounts 0030.

You usually multiply the number. 1 in our ratings of the Best Tax Software and the Best Mobile Tax Apps of 2022. Taxpayers in the most tax.

Child Tax Credit. When we think about all of the taxpayers who are eligible for the Child Tax Credit I mean this is a huge issue Greg Kling an associate professor at USC. After the boosted version lapsed at the end of 2021 the child tax credit reverted to its earlier form which provides annual lump-sum payments but excludes the poorest families.

Tax season can be stressful for the millions of Americans who owe money to Uncle Sam. You Could Get a Double Payment in February Heres Why More CTC. It may also be a credit granted in recognition of taxes already paid or a form of state discount applied in certain cases.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. About 35 million US. With the cost of adoptions continuing to increase and thousands of children in the US.

What the numbers mean The numbers in an employees tax code show how much tax-free income they get in that tax year. They too prefer to do business with a national bank 28. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount.

Advance Child Tax Credit. And around the world in need of permanent families NCFA is committed to advocating for legislation that offers meaningful resources to.

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

The 2021 Child Tax Credit Implications For Health Health Affairs

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

The 2021 Child Tax Credit Implications For Health Health Affairs

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 Update Surprise New 175 Payments On The Way As Exact Date 2 200 Refund Check Is Due Revealed

Adoption 101 The Adoption Tax Credit Tax Credits Adoption Tax

A Simple Error Calculating The Child Tax Credit Could Delay Your Tax Refund

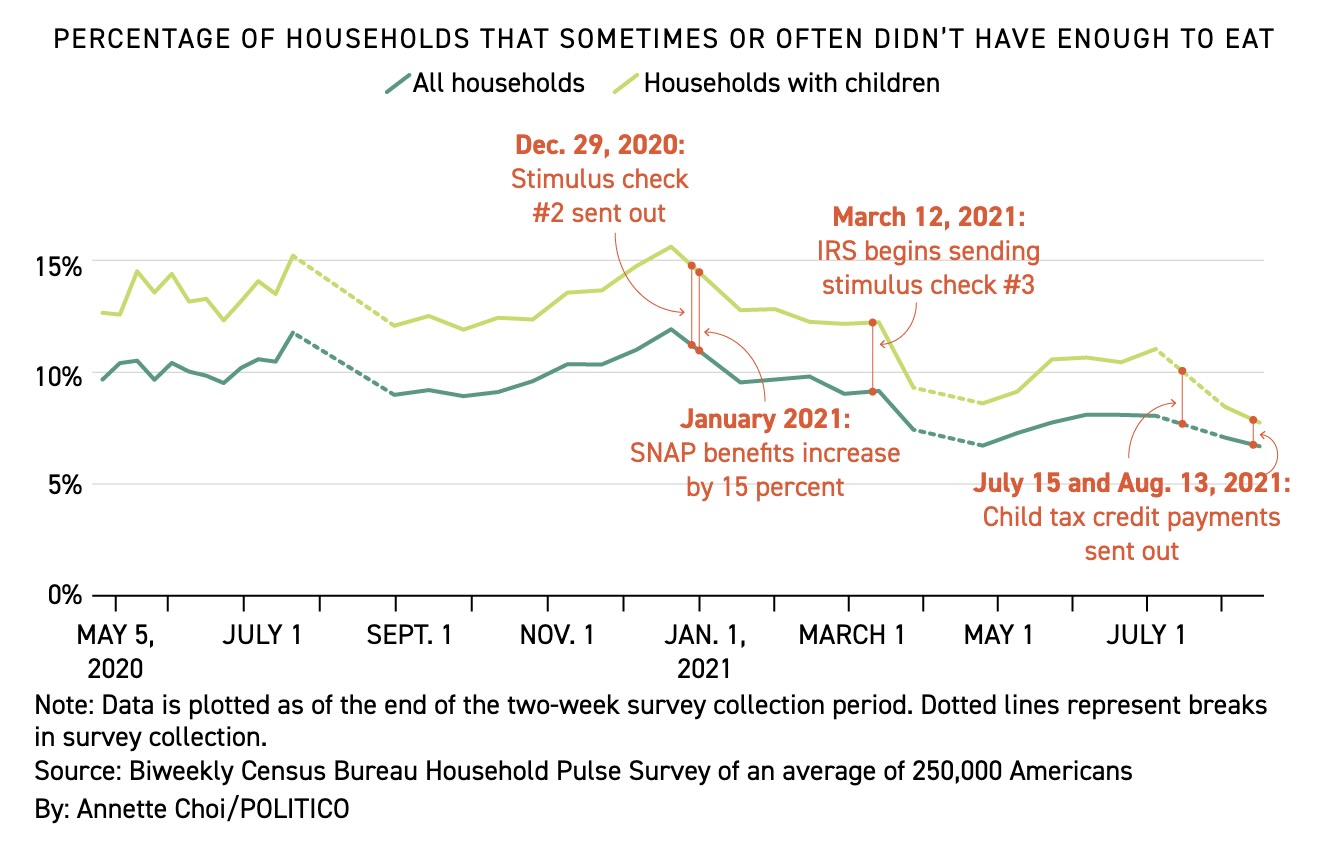

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Annette Choi Annette Choi Twitter

The 2021 Child Tax Credit Implications For Health Health Affairs

Closing Costs That Are And Aren T Tax Deductible Lendingtree